tax avoidance vs tax evasion australia

Tax Evasion Fraud. In tax avoidance you structure your affairs to pay the least possible amount of tax due.

One Third Of Big Businesses In Australia Still Don T Pay Any Tax Five Years Into Ato Crackdown Tax The Guardian

Tax avoidance tax aggressiveness tax sheltering and tax evasion by relating them to the seminal notion of effective tax planning presented in Scholes and Wolfson 1992.

. Tax Evasion Fraud. Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments. As a result individuals or businesses get into trouble with the Internal Revenue Service IRS when they attempt to engage in.

A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of. Many different Federal and State offences fall under the. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or.

Tax evasion is a serious offense and those found guilty can be fined andor jailed. I develop a unifying conceptual framework of corporate tax planning. In Australia tax fraud is criminalized by both the Federal Government and State Governments.

This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion. Whereas tax avoidance although not illegal are ways in which the taxpayer uses strategies to minimise tax within the limits of the law. Tax avoidance is immoral that tends to bend the law without causing any damage to it.

These strategies are commonly referred to as tax minimisation. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of. Imprisoned for up to five years.

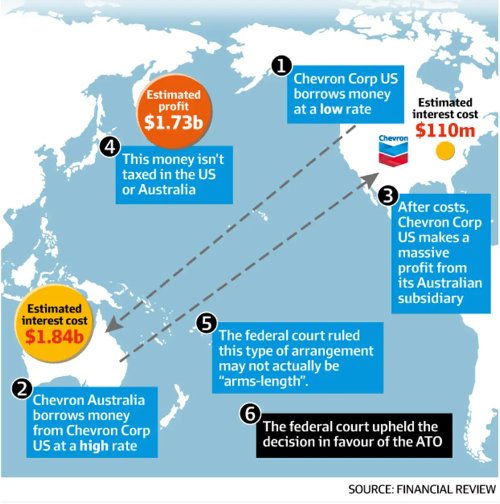

A taxpayer charged with tax evasion could be convicted of a felony and be. Tax fraud is a serious crime and carries a maximum penalty of up to 10 years imprisonment. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget.

Companies like Apple Starbucks etc. But tax evasion is illegal. In tax evasion you hide or lie about your income and assets altogether.

TA 20205 Structured arrangements that provide imputation benefits on shares acquired where economic exposure is offset through use of derivative instruments. II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is considered an act within the law. Difference Between Tax Evasion and Tax Avoidance.

Common tax avoidance arrangements. Tax evasion Over time these concepts have become somewhat blurred. Tax evasion means concealing income or information from tax authorities and its illegal.

Tax avoidance means legally reducing your taxable income. Tax evasion and multinational tax avoidance Treasurygovau. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax.

A few years ago it was discovered that such companies had an effective tax rate of 5 - 10 for US tax well below the 21. Within recent time however there are cases where avoidance is declared as illegal. The Government of any country offers areas and multiple options to the public and entities in reducing and encouraging investments that serve as tax-saving instruments.

Or both and be responsible for prosecution costs. Tax fraud also commonly known as tax evasion is the illegal abuse of the taxation system for financial benefit. There is tax avoidance or tax planning which is completely legal.

Fined up to 100000 or 500000 for a corporation. Mens Rea also known as ill-intention or fraudulent intention is one of the primary factors considered when trying to determine the difference between tax evasion and tax avoidance. Underground economyMoney-making activities that people dont report to the government including both illegal and legal activities.

These forms of criminality are issues not only in Australia but all over the globe. The Australian government set up organisations groups and legal groups to crack down tax crimes and the people behind these misconducts. Unlike tax evasion which is illegal and objectionable both according to law and morality.

Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Tax evasion is an illegal act by which a taxpayer tries to portray to the authorities that he or she is liable to pay lesser tax than their actual liability if they would disclose their. TA 20214 Structured arrangements that facilitate the avoidance of luxury car tax.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Have enlisted the aid of CPA and law firms to assist them in minimizing their worldwide taxes. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments.

While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. The two biggest tax crimes are tax evasion and tax fraud. Tax evasionThe failure to pay or a deliberate underpayment of taxes.

An unlawful act done to avoid tax payment is known as Tax Evasion. The major difference between tax avoidance and tax evasion is that the former is legal while the latter is illegal Murray 2017. Tax evasion occurs when there is a legitimate attempt to get out of paying tax.

There are a number of penalties that authorities could apply such as a failure to file penalty or an underpayment penalty. TA 20211 Retail sale of illicit alcohol. To put it plainly tax evasion is a criminal act.

The framework accommodates constructs frequently studied in empirical tax accounting research ie.

Pin By Accounts House Ltd On Uk News Certified Accountant Accounting Tax Services

Australia Continues To Host Significant Quantities Of Illicit Funds From Outside The Country And Is Not Money Laundering Dollar Money Anti Money Laundering Law

Multinational Tax Avoidance News Research And Analysis The Conversation Page 1

Taxation In Australia Wikipedia

Corporate Tax Avoidance It S No Longer Enough To Take Half Measures Joseph Stiglitz The Guardian

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

Tax Avoidance Png Images Pngwing

Amid Double Taxation Australia Govt Now Links Bitcoin To Corporate Tax Evasion Bitcoin Corporate Australia

Explainer The Difference Between Tax Avoidance And Evasion

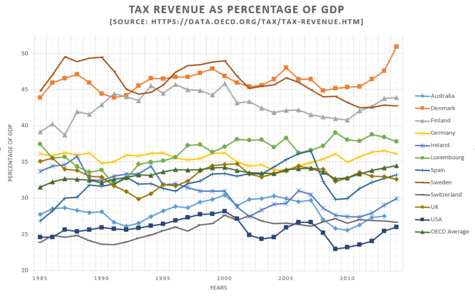

How Do Taxes Affect Income Inequality Tax Policy Center

Taxation In Australia Wikipedia

Tax Avoidance Vs Tax Evasion Infographic Fincor

Taxation In Australia Wikipedia

Tax Avoidance Vs Tax Evasion Expat Us Tax

Tax Evasion In The Oil And Gas Industry National Whistleblower Center

Tax Evasion Is Unlawful Tax Avoidance Is Legal To Arrange Your Affairs In A Such A Way So As To Minimize Tax Is Quite Legal Tax Avoidance Www Trustdeedr